December 2015: the month the Federal Reserve raises interest

rates?

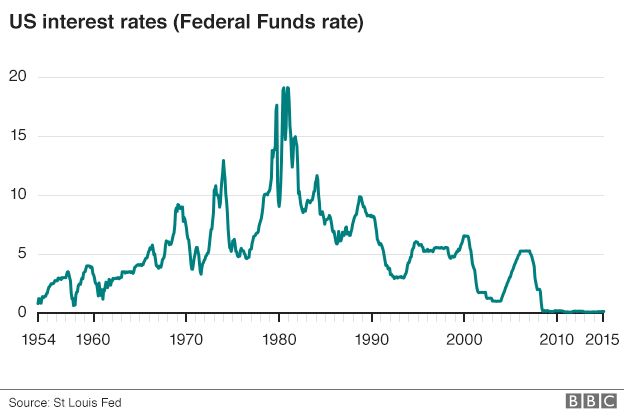

Many feel that the Federal Reserve will raise

rates this December, resulting in the first rise since 2006. Indeed, Federal

Reserve Chairwoman Janet Yellen stated that a rise in interest rates was a

“live possibility”.

On average, 250 000 jobs are being created in

the US economy each month and unemployment has halved from its peak level in

2009. In October, unemployment decreased by 271 000. Moreover, the US

unemployment rate is at 5.1pc, whilst the natural rate of unemployment is

between 4.9 and 5.2pc. Therefore this increase in employment is expected to fuel

inflation, as more people will have a larger income, and so would consume more.

This would create a multiplier effect, creating further jobs in the economy and

increasing inflation still further. Therefore, as it is the Fed’s role to

ensure that inflation meets its 2pc target, it should increase interest rates in

order to ensure the multiplier does not result in inflation exceeding this

target.

However, although more jobs were created in

October than the average, this by itself does not provide a strong case for the

Fed to raise rates. Firstly, we must remember the statistical idea of regression to the mean. Nevertheless,

if more than 271 000 jobs are created in November, then we may be justified in believing

that the US is on the road to recovery and so rates should increase.

However, although employment may increase,

inflation may not necessarily rise in line with employment. This is because the

most significant cause of the low rate of inflation in the US currently is the low price of commodities from China. It

seems highly unlikely that prices will increase, especially since China is

expected to shift from focusing on the manufacturing sector to specialising in

services and consumption. Thus, it is likely that global oil prices will remain

subdued, and thus the cost of manufactured goods will also. Therefore, it seems

that the Fed needs to balance the potential inflationary pressures which would

arise due to the multiplier effect, along with the potential deflationary

pressures from depressed global demand, in order to decide whether to increase

interest rates.

However, it should be noted that the reduced

price of imports may serve to increase

consumer spending in the domestic economy, because citizens’ real wages

would increase. This would accelerate the multiplier effect in the domestic

economy. Indeed, the rate of inflation in the US economy, excluding food and

oil, has increased by 0.2pc in October. Indeed, consumer spending grew by 3.2pc

in the third quarter. Therefore, it seems apparent that the Fed should increase

rates, as the US faces will face inflationary pressures both from increased

employment and from the effect of cheaper imports.

On the other hand, due to this wave of

deflation and reduced increase in inflation, rather than tightening monetary

policy, other central banks across the world have loosened their monetary

policies. For example, Mario Draghi has extended his Quantitative Easing

programme for the Eurozone. Moreover, it is likely that the Bank of Japan will

follow in order to increase inflation, as currently it is officially back in a

recession.

Moreover, since 2014 the dollar has been

appreciating, thus resulting in cheaper imports and more expensive exports for

the US. Therefore, it has been stated that the Federal Reserve does not need to

raise interest rates since the markets have tightened monetary policy. Further

tightening may result in a decrease in the rate of inflation, meaning that the

Federal Reserve would not meet its aim of reaching 2pc inflation. Although this

in itself does not provide a strong argument against inflation, it does

highlight that the Fed should not increase the interest rate too much. It

should perhaps only increase the rate by 0.25pc, before evaluating the effect

of the raise and then deciding what to do further in a couple of months’ time.

Currency wars

However, sceptics argue that should the Fed

raise interest rates, then this would result in the dollar appreciating, as

more investors choose to invest into the US. This would result in exports

becoming more expensive, reducing their demand and thus the total value of

exports. An appreciation would also lead to imports becoming relatively cheaper.

This could therefore increase the demand for imports, reducing demand for

domestically produced products and so potentially reducing the rate of increase

in inflation. Therefore, the total value of imports is likely to rise. The

combined effect would be for the current account to deteriorate. However, due

to the potential for decreased aggregate demand within the US economy, this

could lead to the rate of increase in inflation decreasing, thus pushing the US

economy back into a recession. However,

as mentioned above, this may not necessarily decrease aggregate demand, because

US citizens may spend more in the domestic economy, increasing the multiplier

in the economy, and thus supporting an increase in the rate.

Nevertheless, the appreciation of the dollar

is likely to accelerate capital outflow

from emerging markets and to the US, thus depreciating the currencies of

the developing world whilst appreciating the US dollar. This would have a negative effect on emerging

markets since their debt is heavily

dominated in US dollars and this would increase as the dollar appreciates. Indeed,

corporate debt in emerging markets already currently accounts for 75% of GDP, a

25% increase since 2008. This would not inevitably prove to have a negative

effect, but the fact that there has been a reduced global demand for exports

from these emerging nations means that GDP will decrease while the debt burden

increases due to both the strength of the dollar and the reduction in GDP. Moreover,

emerging markets who peg their currency against the dollar will see their currencies appreciate, and so their

exports will become less competitive and so their GDP is also likely to fall. Thus,

from the point of view of emerging markets, the Fed’s decision to interest rate

would not be in their best interests. Moreover, an increase in interest rates

could increase the rate of capital outflows from China, as assets dominated in

US-dollars become more attractive. However, this would be damaging for the US

economy in the long-run since China is a major buyer of US Treasury bonds.

Animal Spirits

On the other hand, a rise in interest rates may increase

investor confidence. After the publication of the Federal Reserve’s minutes,

the Dow Jones increased by 0.9%, whilst the Standard & Poor 500 increased

by 1%. A slight increase in interest rates may signal to the world economy that

the US has finally recovering from the Financial Crisis. Therefore, this could

also increase investment by businesses, thus leading to further employment

opportunities.

However, others would argue that an increase

in interest rates would cause ‘Zombie

companies’ to become bankrupt, as they would no longer benefit from extremely

low interest rates. They would not be able to borrow at high interest

rates as they would not be profitable enough. Therefore, sceptics would argue

that the Fed should not increase the interest rate, as unemployment would

increase following the closure of these ‘Zombie companies’. However, this can

not be seen as a strong case against an increase in the interest rate. Indeed,

should these ‘Zombie companies’ cease to exist, then their employees would be

released and can then be hired by more successful enterprises, thus ensuring

allocative efficiency.

Consumers

An increase in interest rates would ensure

that savers receive more for their deposits. However, an increase in interest

rates would also mean that credit card bills, car loans and mortgages would

become more expensive to finance. An increase in the interest rate for

mortgages and car loans would mean that consumers would have less disposable

income left to spend in the economy and increase aggregate demand. Moreover, an

increase in interest rates would also reduce demand slightly from potential new

homeowners and car owners as they would find these purchases more expensive and

so would postpone their purchase into the future. Therefore, although on a

microeconomic level most consumers may not wish to see an increase in interest

rates, it would help the Fed to ensure that they do not overshoot the 2%

inflation target.

To Hike or not to hike?

Following a moderate increase in both

inflation and employment, there is a relatively strong economic case which

favours the Fed increasing interest rates. Although oil prices are likely to

remain subdued, this should ensure that Americans will have more disposable

income to spend on domestic goods, thus stimulating further employment through

the multiplier effect. However, the rate increase should not be too high. Indeed,

Japan’s experience has highlighted that if monetary policy tightens too early

then severe economic costs could ensue, namely persistent deflation. This is

further supported by recent experiences in the Eurozone- the ECB increased

interest rates in 2011, but the result was a double-dip recession, forcing the

ECB to bring rates crashing back down. A small increase, say of 0.25pc, would

help to increase business confidence and would be small enough to encourage

investment, creating further employment opportunities. As the dollar has

already appreciated, the interest rate does not need to increase to such a

great extent, especially as this may cause less investment and dampen consumer

spending when it finally seems to have recovered.

References